Another difficult year for the U.S. housing market

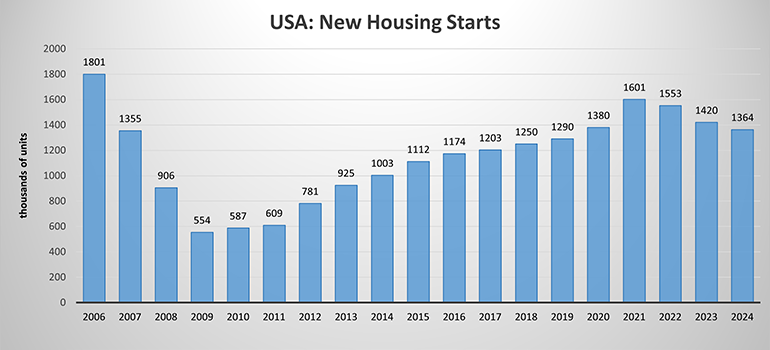

In 2024 the U.S. residential construction decreased for the third consecutive year. Total new home starts were 1.36 million, down 3.9% on 2023. The outlook is negative also for the year 2025.

2024 was another year of struggles for the U.S. residential market. Feeling the pinch from high mortgage rates, inflation, rising material costs, labor shortages, increasing home prices, and nervous buyers, the housing market continued to decline. Total new home starts fell for the third consecutive year for the first time in fifteen years. The 1.36 million units started in 2024 represented a 3.9% decrease from the previous year.

According to U.S. Census Bureau, while the 1.01 million single-family new home starts in 2024 represented a 6.5% increase vs. 2023, multi-family starts (354,800 units) were down 24.9% over the same timeframe. Single-family starts comprised 74.0% of all new home starts last year.

The National Association of Home Builders (NAHB) projects 2025 total housing starts to fall 2.6% to 1.33 million units, with single-family starts rising 0.2% but multifamily starts declining 10.7% from 2024.

Existing single-family home sales last year were at 3.67 million units. Although this represented a marginal increase vs. 2023 (+0.3%), it was the third lowest annual total since the mid-90s. Additionally, the median sales price of existing single-family homes in 2024 was $412,400, a 4.6% increase from 2023 and a record high. This also was a 50.2% increase from just five years ago, when the median existing single-family sales price was $274,600.

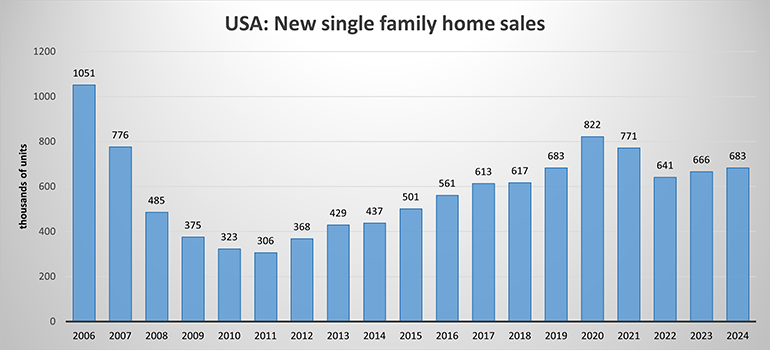

New home sales rose for the second straight year (+2.5% vs. 2023) but have not come close to approaching their level prior to the Great Recession. In fact, new home sales in 2024 (683,000 units) were down 46.8% from the record high of 1.28 million units sold in 2005 (source: U.S. Census Bureau).

Mortgage rates were at an annual average of 6.72% (30-year fixed) in 2024. Other than the slightly higher 2023 rate (6.81%), this was the highest annual mortgage rate since 2001 (source: Freddie Mac).

In some positive news, U.S. foreclosure filings, a key inverse indicator of the housing market’s health, fell 9.8% vs. 2023. The 322,000 foreclosure filings last year represented the third lowest annual total on record (source: ATTOM Data Solutions).

Also on the positive side, overall total U.S. construction spending (includes private and public residential and non-residential construction) increased for the thirteenth year in a row, reaching an all-time high of $2.15 trillion in 2024, up 6.5% from the preceding year (source: U.S. Census Bureau).

Did you find this article useful?

Join the CWW community to receive the most important news from the global ceramic industry every two weeks