Poor residential sector performance dampens construction growth in Europe

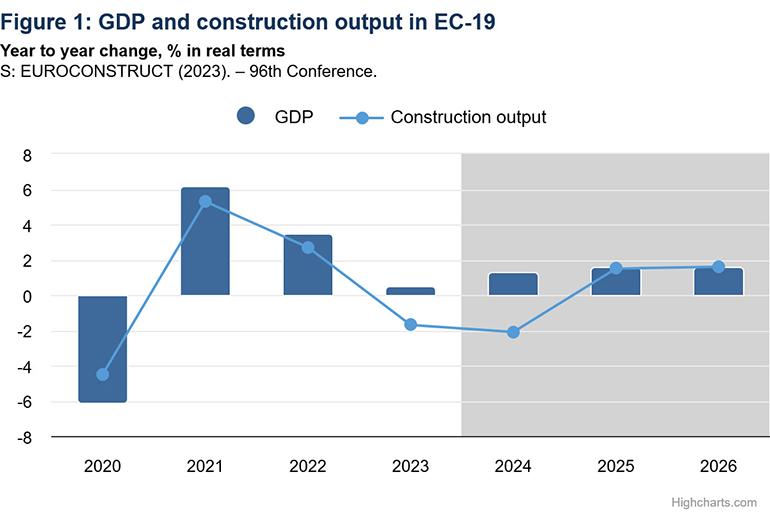

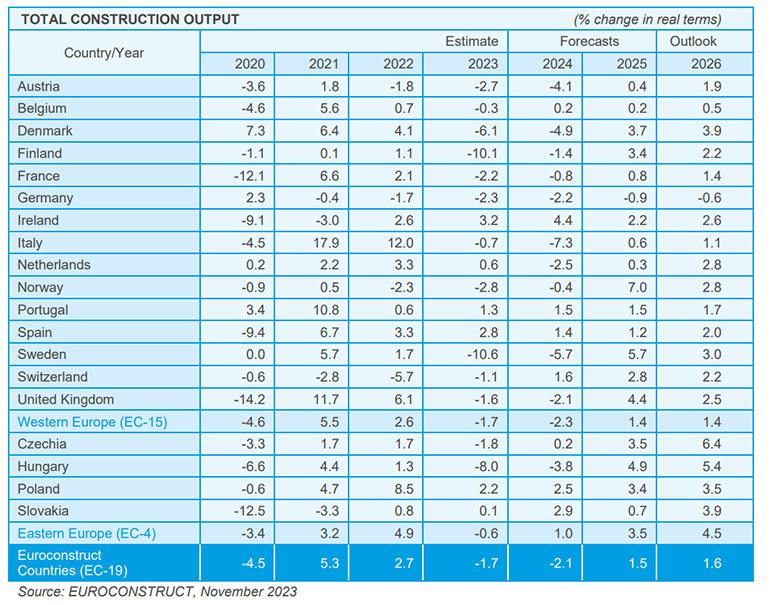

Euroconstruct has revised down its 2023 estimates (-1.7%) and 2024 forecasts (-2.1%). The construction sector is expected to resume growth from 2025 onwards.

Following unexpected growth in 2022, the construction industry in the 19 Euroconstruct countries faced a more challenging economic environment in 2023. The ongoing crisis in Ukraine together with high interest rates and rising inflation contributed to an estimated 1.7% decline in construction output, with market conditions expected to deteriorate further in 2024. Despite these challenges, industry experts are predicting an annual growth rate of 1.5% in both 2025 and 2026, bringing output back to 2016 levels.

Residential construction expected to contract throughout 2024

Within this overall context, there are notable variations between different sectors. Civil engineering performed strongly in 2023 and is projected to continue its expansion until 2026. By contrast, non-residential building construction is expected to experience stagnation until the end of 2024, followed by a resumption of growth.

Residential construction is without question the most critical segment, contributing to an industry-wide downturn. It is projected to lose market volumes until the end of 2024, with only modest growth anticipated in subsequent years. This residential slowdown will be particularly pronounced in Sweden, Italy, Finland and Hungary. However, countries with larger residential markets such as the UK, Germany and France are also facing considerable losses.

High mortgage interest rates are the most significant factor behind the downturn. The European Central Bank reported a notable tightening of lending standards across all loan categories in the third quarter of 2023, resulting in a substantial decrease in demand for credit from both companies and households. For September, the ECB reported an average interest rate of just under 3.6% for 10-year mortgages compared with just under 1.4% at the beginning of 2022.

As a result, by 2025 the number of housing completions is expected to fall to the lowest level since 2016.

In 2023, the downturn in the residential sector also prompted a decline in renovation work, which is expected to continue to contract in 2024. By contrast, non-residential building renovation saw an upward trend that is projected to continue in the current financial year and outperform new construction.

Another factor hampering recovery is consumer price inflation, which is expected to remain above historic norms in many countries in 2024, apart from a small minority of countries where it is expected to fall below the 2.5% mark.

Civil engineering is proving the most resilient sector

As mentioned, civil engineering will be the most resilient sector, with a robust outlook fuelled by public sector investments. Upward revisions in forecasts are being observed above all in the energy sector and, to a lesser extent, in road construction. In the current socioeconomic and political climate, growth in this sector is propelled by the urgent need for projects relating to transport networks and energy production and distribution. The fact that these projects will take years to complete means that the long-term outlook for the civil engineering sector remains positive.

Did you find this article useful?

Join the CWW community to receive the most important news from the global ceramic industry every two weeks