European construction looks set to stagnate

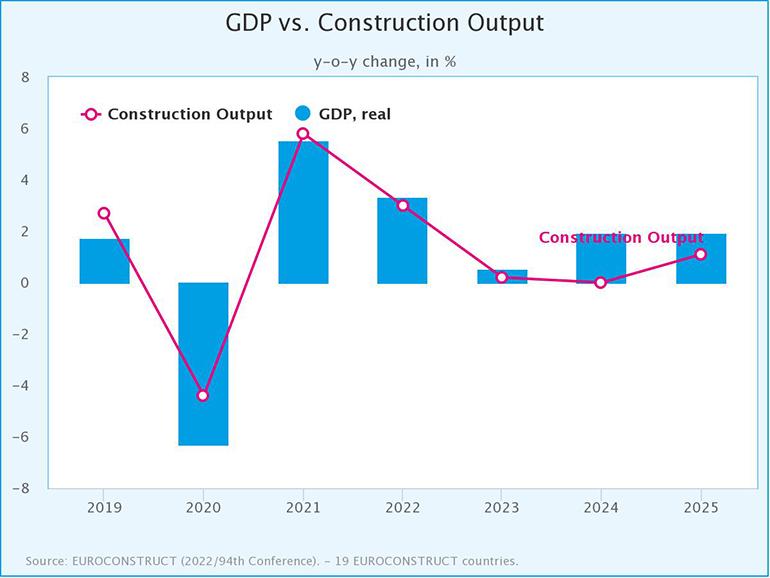

Euroconstruct’s latest economic forecasts predict that construction output growth will drop to 0% in 2024 across Europe. Civil engineering looks positive, but other sectors are expected to be negative.

New economic data points to a difficult two years for construction across Europe, with growth forecasts dropping to 0.2% in 2023 and a flat 0% in 2024 compared to 2% previously.

Despite a more positive 2022 with 3.0% growth expected, construction output is likely to be weaker than previously thought, with no recovery expected until 2025.

These forecasts were presented at the 94th Euroconstruct Conference, which was held in London on the 18th November 2022, hosted by Barbour ABI and Experian.

Mohammed Chaudri, Chief Economist of Experian said:

"During the past six months, there have been enormous changes in Europe that have impacted the economic operating environment of construction. The Ukraine war and the manifold impacts and uncertainties it induces, rising interest rates, the tightening of the financial market, and the ongoing problems with construction material availability and costs are all playing a significant part. Euroconstruct’s November forecast found that nearly all factors which affect construction demand are negative, including the economy, consumer prices, interest rates and consumer confidence. It looks like it could be a rough period of adjustment for the industry, before a return to growth in 2024.”

Residential leads downturn

Much of the negative outlook is driven by the new residential and residential renovation sectors. The era of low interest rates led to a boom in new-build housing across Europe, but the situation has changed substantially in the past six months. Housing sales have slowed down, consumer confidence has dropped and there is now oversupply in many countries. The result is that the growth outlook for next year’s new residential construction has turned negative. The picture does not improve when looking at the construction sector as a whole.

Tom Hall, Barbour ABI’s Chief Economist added:

"The construction industry is experiencing headwinds from multiple directions and things are changing quickly. The economic growth predictions for 2023 have moved accordingly. It was only as recently as June that we were expecting 2.2% growth in GDP – this is now as little as 0.5%. Businesses would do well to diversify their portfolios, especially if they are focused on residential projects. There is a glimmer of light though, with civil engineering looking more positive as many countries invest in low-carbon energy and renovate existing infrastructure.”

Country by Country

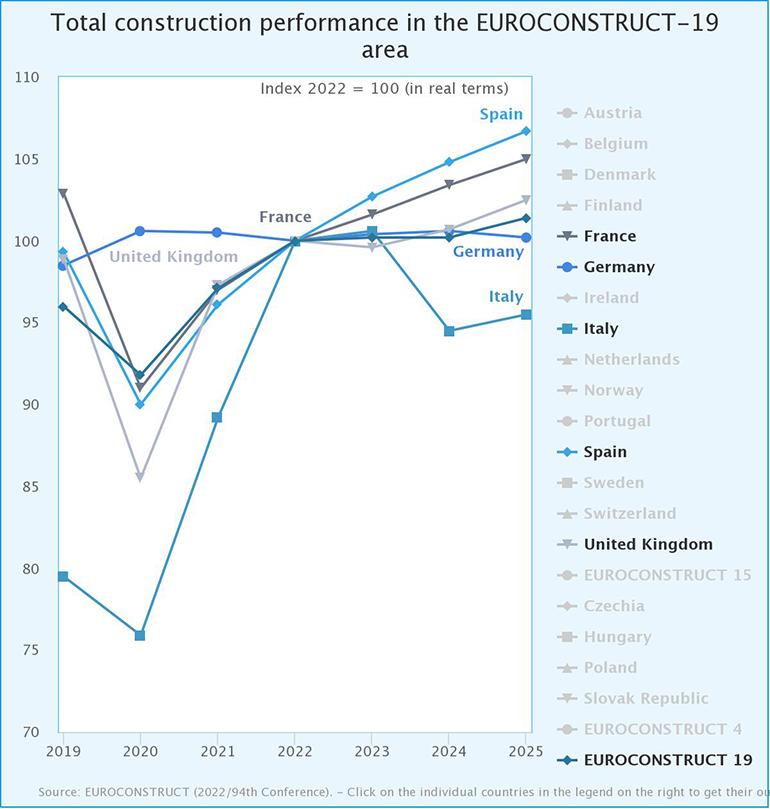

Italy was the best performer in Europe in 2021, with a high growth level of 12.1% driven in part by EU subsidies. The UK, currently one of the worst-performing economies in Europe, faces a negative construction output growth cycle in 2023 (-0.4%) alongside Germany, which faces a negative or stagnating outlook for growth all the way up to 2025 (-0.4%). Construction will also contract in eight countries, the most in Sweden and Finland. In both countries, construction has been high, so the decline partially marks a return to a more normal construction volume.

Did you find this article useful?

Join the CWW community to receive the most important news from the global ceramic industry every two weeks