European construction market forecasts to 2025

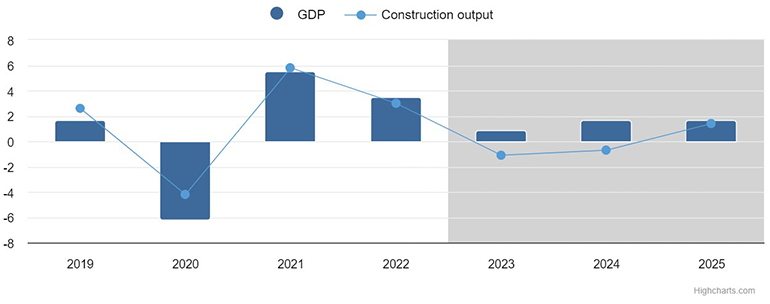

Euroconstruct confirms a +3% growth in 2022, while revising downward the new forecast for 2023 (-1.1%) and 2024 (-0.7%).

by Thomas Endhoven, EIB Economic Institute for Construction and Housing (Amsterdam, Netherlands)

The continuation of the war in Ukraine and the severe energy crisis, along with the sudden changes in monetary policy, were initially pointing towards a recessionary outlook for the European economy. However, in recent months, it has performed better than expected due to lower energy prices, reduced supply constraints, improved business confidence, and a strong labor market. In 2022, for the European construction sector a growth of 3% is confirmed, within an overall expansionary economic environment. In contrast, the new forecast for the European construction sector has been revised downward, with a shift from the previous assumption of stagnation in 2023 to an anticipated reduction in volumes.

Risks and uncertainties impeding the growth of the European construction market have been discussed at the 95th Euroconstruct Conference, that was held on 8-9 June 2023 in Amsterdam. The factors that explain the gradual slowdown in growth, leading to a contraction in construction spending levels in 2023, have been developing and solidifying over time, such as weaker momentum of the global economy, inflation, change in monetary policy direction and the consequent rise in interest rates. The latest forecast now projects a decline of 1.1% this year, followed by a further contraction of 0.7% in the subsequent year, highlighting the challenging outlook for the construction industry whose expectations of recovery have been postponed to 2025.

The sharp rise in inflation in 2022, caused, among others, by the energy crisis, forced central banks to raise interest rates sharply and, as a result, worsened the ability to finance housing investment. Mortgage interest rates have doubled in most European countries in 2022 and tripled in Finland, Slovakia, Switzerland and the UK.

According to the current forecast, total residential output in 2023 in the Euroconstruct countries will be lower than in 2022. The shrinkage is foreseen to continue for yet another year. EC-4 countries (Poland, Czechia, Hungary, Slovakia) are predicted to witness a bigger decrease in residential construction output than the EC-15 countries (see table). Recovery for both regions of Euroconstruct might start in 2025.

The clear slowdown of economic growth will undermine non-residential construction in the next few years. In 2022, the output of total non-residential construction increased compared to the 2021 level. Last year total non-residential construction accounted for 29.2% of total construction output across the Euroconstruct network. Growth projections for output in the field have remained the same as in the previous report (November 2022). A slight growth is forecast for this year, while growth will likely pick up marginally in the remaining period. Production output is prognosticated to exceed the 2019 pre-pandemic level in 2025.

The impact of the business cycle is smaller for civil engineering due to many long-term projects and a high share of activities financed by the public sector. Multinational funds in the EU have generally been a stabilising factor. Additionally, in economic downturns, governments often implement economic stimulus packages for the construction sector which contained maintenance and improvements of existing infrastructures as well as new infrastructure projects. The growth rates of civil engineering works outperform the development in the building sectors and show continuous positive growth from 2021 until the end of our forecast period. The annual growth rates projected for 2023-2025 are rather moderate, though.

Figure 1: GDP and construction output in Euroconstruct-19 area

Year to year change, % in real terms

|

2019 |

2020 |

2021 |

2022 |

2023 |

2024 |

2025 |

|

|---|---|---|---|---|---|---|---|

| Austria | 3.6 | -3.4 | 5.8 | -0.8 | -1.2 | -1.8 | 0.7 |

| Belgium | 1.1 | -5.0 | 6.2 | 1.5 | -0.3 | 3.0 | 1.6 |

| Denmark | 1.6 | 8.8 | 6.6 | 5.5 | -1.1 | 0.1 | 1.8 |

| Finland | -2.5 | -1.2 | 1.2 | 0.8 | -5.9 | 0.9 | 0.3 |

| France | 2.3 | -10.4 | 8.2 | 2.8 | 0.3 | 0.7 | 1.2 |

| Germany | 1.5 | 2.3 | 0.1 | -1.5 | -2.2 | -1.6 | -0.8 |

| Ireland | 5.8 | -9.1 | -3.2 | 10.3 | 2.1 | 5.9 | 4.9 |

| Italy | 3.5 | -4.6 | 18.0 | 12.4 | -0.5 | -6.0 | 1.5 |

| Netherlands | 5.3 | 0.2 | 2.3 | 3.3 | -1.9 | -2.1 | 1.2 |

| Norway | 1.0 | -1.0 | 0.4 | -1.9 | -0.3 | 0.2 | 4.1 |

| Portugal | 8.4 | 3.4 | 15.3 | 0.5 | 1.2 | 1.5 | 1.5 |

| Spain | 4.6 | -9.3 | 6.7 | 3.6 | 3.2 | 2.5 | 1.5 |

| Sweden | 0.3 | -0.4 | 5.0 | 1.4 | -8.2 | -2.9 | 4.7 |

| Switzerland | -0.2 | -0.6 | -3.0 | -3.7 | -0.9 | 0.9 | 1.7 |

| United Kingdom | 2.2 | -13.9 | 11.7 | 5.6 | -1.5 | 1.1 | 2.7 |

| Western Europe EC-15 | 2.4 | -4.2 | 5.9 | 3.0 | -1.0 | -0.8 | 1.2 |

| Czechia | 3.5 | -3.3 | 1.7 | 2.9 | -3.5 | 1.1 | 3.1 |

| Hungary | 16.8 | -6.6 | 4.4 | 2.5 | -7.6 | -3.1 | 3.3 |

| Poland | 5.0 | -1.7 | 3.8 | 5.1 | 0.9 | 2.5 | 4.0 |

| Slovakia | -4.7 | -12.7 | -3.7 | 0.1 | 1.1 | 3.1 | 2.1 |

| Eastern Europe EC-4 | 5.9 | -3.6 | 3.0 | 3.8 | -1.7 | 1.3 | 3.5 |

| Euroconstruct Countries EC-19 | 2.6 | -4.2 | 5.8 | 3.0 | -1.1 | -0.7 | 1.4 |

Fonte: WWW.EUROCONSTRUCT.ORG

Did you find this article useful?

Join the CWW community to receive the most important news from the global ceramic industry every two weeks