European construction: recovery expected by 2025

During the 97th Euroconstruct conference the new forecasts for the European construction sectors.

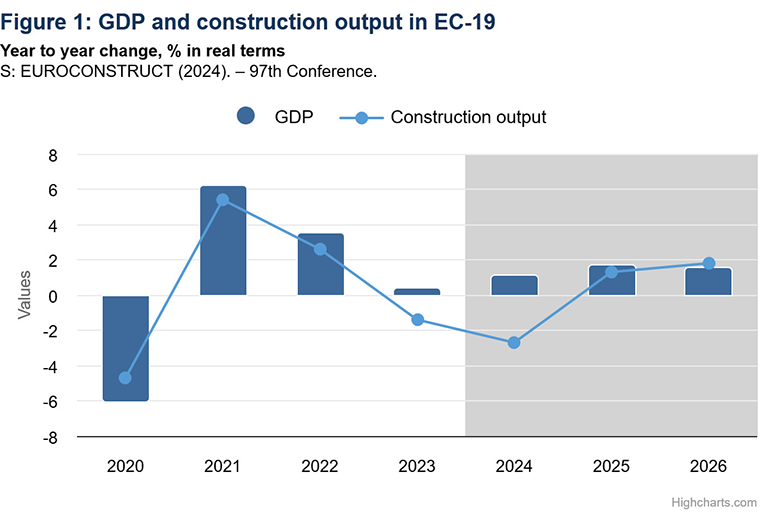

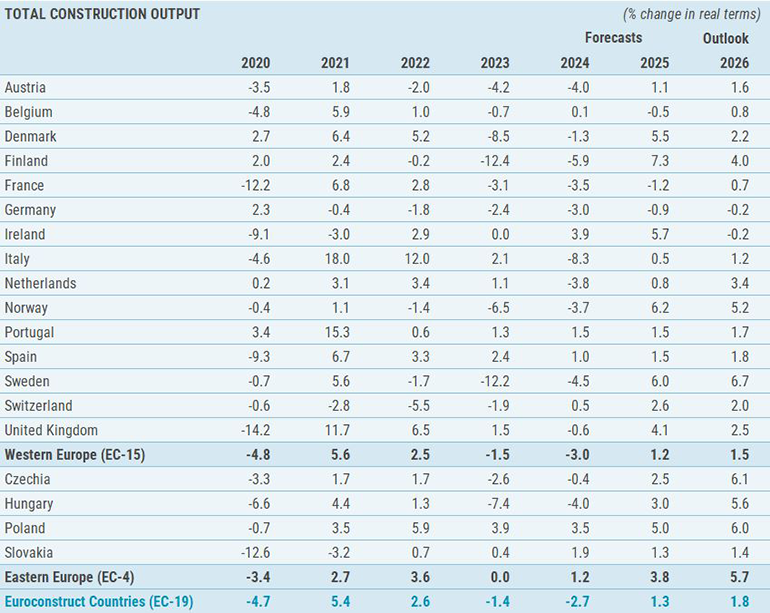

The total construction output in the Euroconstruct area fell by 1.4 percent in 2023, which was slightly better than expected six months ago. The negative trend will continue in 2024 with a decrease of 2.7 percent, mainly caused by significant challenges in the new residential sector in 15 of 19 Euroconstruct countries. A positive turning point is expected in 2025, with the positive trend continuing in 2026. This according to the new forecasts for the European construction sectors published at the 97th Euroconstruct conference in Stockholm on the 11th of June 2024.

The dampening factors for the current year

The economic outlook in the Euroconstruct area is rather mixed. After last year’s modest growth (+0.4 percent), with declines in economic output in a total of seven member states, progress is likely to remain moderate (+1.1 percent) in 2024. Growth in private consumption and exports will stay modest. Although the economy will pick up somewhat in 2025, the 2 percent mark remains unattainable from today’s perspective, given the numerous dampening factors (e.g., after-effects of the inflation shock). The most positive figures in overall economic activity for the 2024-2026 period are expected in Ireland and Hungary. At the other end of the scale, we find Italy and Germany.

The dampening factors also include the continued rise in interest rates and high national budget deficits. Both are seen by the EUROCONSTRUCT partners as clear obstacles to European construction activity. The limited financial leeway of the central states, as well as regional and local authorities, can have negative consequences on possible tax relief or financial injections, the provision of funding programs, or direct construction demand from the public sector.

Access to credit towards normalization

The picture is similar for financing conditions. This influencing factor is said to have a decidedly negative effect on all main segments. The sharp rise in interest rates in a very short period has made it considerably more difficult for private households and companies to finance construction-related projects, and the situation is only slowly normalising. According to the ECB’s latest Bank Lending Survey, demand for private home loans in the eurozone has at least stabilised recently. However, corporate demand for credit weakened again until the start of the second quarter of 2024 and was still clearly in negative territory on balance. In contrast, credit requirements for house purchases by private households appear to have been handled somewhat less strictly for the first time since 2021, while banks continue to act very cautiously regarding the other forms of credit for this demand group.

The problems of recent years (e.g., interest rate turnaround, inflation, rise in construction costs) will continue to weigh on building construction, while civil engineering is expected to expand strongly in 2024. The expansion is driven by a variety of investment needs, but above all by the financial backing of governments.

Did you find this article useful?

Join the CWW community to receive the most important news from the global ceramic industry every two weeks